Photo by Unforgettable moments for Ipas

The Ipas Impact Network works globally to advance reproductive justice by expanding access to abortion and contraception.

All people have the right to make fundamental decisions about their own bodies and health. That’s why we work with partners across Africa, Asia and the Americas to ensure that reproductive health services, including abortion and contraception, are available and accessible to all.

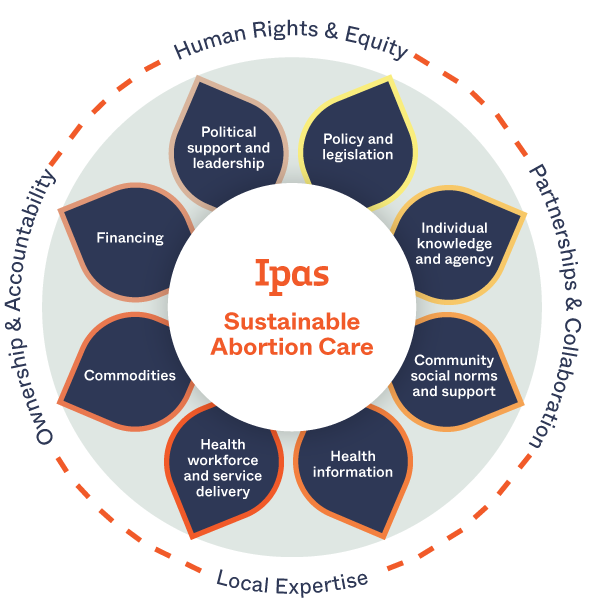

A comprehensive approach

Guaranteeing the right to abortion isn’t enough. We know that economic, cultural, religious, and systemic barriers prevent many people from accessing abortion care even where it’s legal and available.

Our solution: We work across institutions and communities to build sustainable abortion ecosystems. In such an ecosystem, people have the information they need to make decisions about reproductive health, there’s community and health-system support for human rights and abortion access, and laws and policies support full bodily autonomy.

We work for a more just world—and we work in a way that upholds our values.

We are a locally led, globally connected network, and we pay attention to equity, power and accountability in all aspects of how we work.

Learn about how we practice shared leadership.